America; our health care landscape is a mess. Nearly all elderly Americans have federally run Medicare. Veterans are covered by Veteran’s Affairs in a somewhat socialized system. Poor Americans can get coverage via Medicaid, depending on which state administers the program. Poor and sometimes middle-class children can get covered by the Children’s Health Insurance Program (CHIP), once again, depending on the state. And the majority of the rest are covered by Employer-sponsored Health Insurance (ESI) or can purchase it on the Affordable Care Act (ACA) marketplace, or Obamacare. And of course, about 30 million Americans remain uninsured. But why is that? Why is our health insurance landscape so fractured?

In what follows, I’ll try to explain how the United States got such a messy system.

Beginnings

For this, we will have to go back over 100 years. Health care in the 19th and early 20th Century was primitive. Appendectomies, a routine surgery now, was new. Most forms of treatment we consider routine today didn’t exist. Hospitals were in large part charities and many people lacked assess. Regardless, treatment wasn’t what it was today and hospitals were in many ways a place someone went to die. Babies were birthed at home (Fun Fact: Jimmy Carter was the first president born in a hospital in 1924), and the medical trade had little oversight or quality control.

This started to change in the early 20th Century. The Progressive Era was in full swing. Public schools were being created and expanded, states and local governments were fighting for labor protections and a ban on child labor, workplace safety, an expansion of social work to take care of the needy, etc. Along with them, physicians were professionalizing with everyone else. And hospitals were building up as well.

In the 1920s, a group of teachers in Dallas struck a deal with Baylor Hospital to cover any expenses they may incur from getting sick. They got a simple rate and their care would be covered for their hospital expenses. If they got sick, they wouldn’t have to worry about leaving their families with their hospital bills or leaving them to die in pain at home. This plan became Blue Cross. Before this, there were life insurance plans and plans that may resemble workman’s compensation, but not quite like this. In the 1930s, the lumber and mining industries combined efforts to provide basic physician services to their employees. This became Blue Shield. So, you have a hospital insurance plan and a medical insurance plan for basic coverage. Separate companies (until they merged in 1982). People paid premiums and got their care.

When professions were organizing, medical doctors decided dentists and ophthalmologists were not medical doctors. Dentists primarily pulled teeth and ophthalmologists fitted glasses, they were considered distinct from medical doctors providing health advice and care for sickness and old age. So, dentistry and vision care were not covered. But what about Veteran’s Affairs? The Veteran’s Bureau was created in the 1920s following World War One to consolidate care for returning soldiers.

In 1929, the entire economy is brought into chaos with the stock market crash and the beginning of the Great Depression. This provides a contrast between the private sector and charity-focused volunteerism of Herbert Hoover and the policies advocated for by the Progressives. The Progressives advocated for sweeping change for several decades: old age pensions, unemployment insurance, disability insurance, worker’s compensation, education, prohibition of child labor, aid to the needy, the 40-hour work week, workplace safety, union rights, the professionalization of trades like doctors/lawyers/teachers/social workers, and a right to health insurance. Mostly guaranteed by government regulation or even government provision. And in 1932, with the Great Depression still devastating the country, they came back into control with the election of Franklin Delano Roosevelt. FDR not only was a shift from the volunteerist and fairly conservative philosophy of the Republican Party of the last 12 years, but he selected prominent progressive social worker and activist Frances Perkins as his Secretary of Labor over a more conventional pick like a member of the American Federation of Labor (AFL).

In 1934, FDR called for the creation of a system of Social Security and other laws to address these critical shortcomings in our society. Over 14 months, negotiations took place. Many aspects of the law were controversial, but one of the most controversial was the inclusion of national health insurance. The American Medical Association (AMA), American Hospital Association (AHA), large businesses, social conservatives, segregationist Southern Democrats, and even many unions within the AFL were opposed. The AMA and AHA feared a government take over of the insurance sector and the ability of the government to control their payment. Large businesses feared the taxes likely required to fund this system, social conservatives and the GOP were ideologically opposed to the government takeover of the health care marketplace, and segregationists were opposed to aiding African Americans and the potential to desegregate hospitals. Unions like the AFL, typically seen today as an ally of the Democratic Party, were opposed because this meant they could not negotiate better benefits for their members and would not be able to demonstrate their value.

With so much on the line for the Social Security Act, the Roosevelt Administration elected to forgo health coverage from the Act to give it a greater chance for passage. Possibly with the intent to return to it later. But it was not meant to be. Other priorities took precedence, conservative Democrats began to sour on the New Deal and align with the GOP in select cases, and the beginnings of World War 2 demanded the Administration’s attention focus elsewhere.

World War 2

After the United States enters World War 2, the US begins to mobilize for total war. The federal government begins deficit spending in order to prepare for the conflict. Anticipating inflation, they pass the Stabilization Act of 1942 and create the Office of Price Administration. The government sets price controls for many commercial goods, but they also try to cap wage increases to hold down input costs for goods. However, this creates a natural question. If an employer can’t give a raise, how do they incentivize people to join them? Employers find a way around this via employer benefits, including health insurance. And the government decides two things: these benefits are exempt from the cap and that health insurance benefits are not taxable wages. The modern system of ESI as we know it is born via this de facto government subsidy. Over the next couple decades, America’s unions bargain for increasingly better benefits. They even start to add vision and dental benefits in the late 1950s in their own insurance schemes.

Truman’s failure and Eisenhower solidifying The Roosevelt Administration Approach

After World War 2 ends, President Truman attempts to pass a national health insurance plan via a modification to the Social Security Act in 1946 as a part of his Fair Deal programs. Once again, the AMA, AHA, Chamber of Commerce, segregationists, social conservatives, GOP, and unions join forces to kill his plan. Republican Senator Taft goes so far as the call it a “Communist” bill much like opponents called the Social Security Act “socialist” in the 1930s. Not only does Truman fail, but the Democrats temporarily lose Congress for the first time in 14 years. For the remainder of his time in office, President Truman will fail to pass his Fair Deal legislation, and he will be replaced by a GOP Congress and President Eisenhower in 1952.

Once Eisenhower takes office, the GOP is prepared to attempt a rollback of much of the New Deal. And several conservatives want to end the exclusion of ESI from taxes. However, Eisenhower instead decides to make this system permanent, and the deal is struck. If you work in a union covered job, you can expect to have decent health insurance. If you don’t…well good luck.

By 1959, 67% of Americans have some form of hospital insurance. In other words, the uninsured rate is down to 33%. However, if you are elderly, the uninsured rate is as high as 48%!

Aside from that, around this time for-profit health insurance companies began to come into the picture. Previously, plans sold by Blue Cross or Blue Shield would simply give insurance to anyone willing to pay the price. Companies like Aetna realized that they could undercut their prices by assessing health status prior to purchase. Healthy Americans could get generous prices that matched their risk, while sicker Americans were charged higher rates. This further stratified the system where the neediest could be locked out of protection (Read Jonathan Cohn’s Ten Year War for a better explanation than I can give here).

The Creation of Medicare and Medicaid

After Truman’s efforts for national health insurance failed, advocates began to focus in on the most “deserving”, the elderly. They began advocating to simply cover every senior with federally administered health insurance, while the AMA (realizing they cannot simply oppose all policies to enhance coverage) advocates for privately administered and voluntary insurance. In 1960, Congress passes the Kerr-Mills Act, which set up a federal-state matching program for poor Americans aged 65 and older. This creates a base plan for what will become Medicaid, and several dozen states accept the program over the next 4 years to varying degrees of generosity (this variance in generosity will come back frequently). The same year, JFK is narrowly elected (with a strongly Democratic Congress) and he advocates for Medicare, a federally run health insurance system for all elderly Americans. However, JFK is unable to enact his plan and is repeatedly stymied by Congress until he is assassinated in November 1963. Then, everything changes when LBJ assumes the presidency.

LBJ reframes JFK’s New Frontier programs as a drive to create the “Great Society” and wage a “War on Poverty”. As a part of these programs, Congress successfully passes the Social Security Act of 1965. This creates JFK’s Medicare program for the elderly, and the former President Truman is the recipient of the very first Medicare card. Remember how hospital and medical insurance were separate products? This informs Medicare’s design. Medicare is split into two parts: Part A (Hospital Insurance) without premiums for people with 10 years of earnings paid for via a trust fund paid for with a payroll tax, and Part B (Medical Insurance) with premiums to help cover the costs (and subsidized with general revenue). Within a single year, Medicare launches and states begin to set up the other program created by this law, Medicaid. The uninsurance rate for seniors is virtually eliminated in a single year and the rate of insurance coverage jumps to around 80%-85% within a single year. Where it will roughly stay until the ACA.

While Medicare was federally run, Medicaid was a federal-state matching program based on the earlier Kerr-Mills Act. It set up generous (at the time) matching rates with uncapped spending to cover the poor elderly, children, and mothers. States quickly expand and even begin to expand into the middle class. So much so that some of the original advocates for the law advocate a repeal or capped spending, but it does not happen. Most states accept Medicaid by the mid-1970s, and Arizona (the last holdout) accepts Medicaid in 1982.

The United States now has multiple systems. Medicare for the elderly, Medicaid for the “deserving” poor, Employer Insurance for people with good union jobs and professional careers, and a volatile individual market for the rest that many cannot afford and of varying quality.

The Wreckage of Watergate and The Reagan Years

Richard Nixon, Eisenhower’s Vice President, is elected in 1968 and is forced to work with a Democratic Congress the entirety of his Presidency. The “New Deal consensus” is still alive and well, but the programs of the Great Society and the social strife of the era are beginning to show the cracks. Supplemental Security Income, WIC, Food Stamps, Medicaid, and other programs are created and expanded. Nixon begins to work with Democrats on plans like childcare and universal health care. Nixon kills the child care plan in the run up to the 1972 election, but the Watergate scandal begins to erode his popularity. Senator Ted Kennedy advocated for a single payer plan in contrast to Nixon’s own plan for universal health care. Seeing the writing on the wall from the Watergate scandal, Kennedy and the Democrats walk away from a health care law, assuming they can come back to it later. The one thing that does pass is ERISA, which defines employer plans at the federal level and effectively supplants the states in certain areas for the regulation of employer plans. When the ACA builds on this later with the employer mandate, it makes state single payer plans and regulation more difficult by undermining state authority. But it sets federal standards, which can aid in less interventionist states. When President Ford takes over, he had no interest in such a plan. President Carter was either too ineffective to work with Congress, uninterested in a large enough plan, or both. With inflation running rampant, including with Medicare’s billing, Carter focuses on deregulation and getting inflation under control.

With inflation still running strong, the Iranian Hostage Crisis making President Carter look ineffectual, and resent of welfare programs running high, President Reagan is elected in 1980 in a landslide. The Republicans retake the Senate for the first time since 1954 and remains that way until the 1986 midterms. The Democrats will hold the House of Representatives for his entire Presidency. Reagan, a long time New Deal Democrat, joined the Republicans after the election of JFK. He was a staunch Barry Goldwater supporter in 1964. He gave notable speeches such as “A Time for Choosing” and spoke of Medicare as a program that would make Americans yearn for a time when “Americans used to be free.” And yet, with a Democratic House and Medicare a 15-year bedrock of the safety net for the elderly, he was forced to compromise.

President Reagan, rather than attempting futile efforts of repeal, instead focused on piecemeal changes. Medicare inflation had run rampant for years, and he chose to emulate the small government icon of Calvin Coolidge. Even after his initial tax cuts and continuation of President Carter’s deregulation, he opted for tax cuts, welfare benefit cuts, and signed a law in 1983 switching Medicare to its system of diagnosis codes to try and cut costs. But this came at a price. Democrats would also negotiate many tax increases, and repeatedly expanded Medicaid for children and mothers up to 133% of the poverty line (or at AFDC rates) over the course of the 1980s. Medicare, which did not cover hospice care, but modified to do so. And ESI, which previously could expire if workers left or were laid off, were modified with COBRA such that employees could keep their health insurance if they paid the full cost of their premiums.

Some members of Congress were worried that hospitals could deny care to uninsured patients and allow them to die. So, in 1986, they passed a law mandating hospitals must stabilize patients regardless of ability to pay. However, the general structure of our health care system remained the same.

Clintoncare, Children’s Health Insurance Program (CHIP), and W. Bush’s Medicare Part D

After 12 years of compromise between the Democrats and the GOP, President Clinton is elected in 1992 with a majority similar in size to what Obama has after 2008. President Clinton pledges to finally enact a plan for universal health care in the United States. His idea is to subsidize the private purchase of insurance for the self-employed, have an employer mandate for people that work in a business with thousands of workers, address long term care, add a prescription drug benefit to Medicare, have a National Health Board to further enforce physician standards, and use regional health alliances between groups of insurers to control costs.

This plan angered all the usual groups, and millions are spent on ads to turn public opinion against the plan. Furthermore, the coalition of supporters do not agree on the philosophy of the plan. Clinton’s plan was not a single payer plan like Truman’s or Ted Kennedy’s, and liberals were not pleased with a plan that preserved a relatively fractured system run with private insurance plans. But Clinton made the decision to moderate his positions in an attempt to win swing voters. Nevertheless, the GOP threatened to filibuster and with the public turning against the plan over time, health care reform officially died in August 1994. In the midterms, the GOP take back Congress for the first time since 1954, and this time they will hold it for 12 years. The dream for universal care will once again be put on hold.

But Clinton doesn’t give up, and chooses to work with the Republican Congress to pass smaller changes. In 1996, he starts with HIPAA and PRWORA (welfare reform). HIPAA includes rules on patient privacy and access to their own health data, but it also strengthens employer insurance so that people with employer plans must be guaranteed the right to coverage regardless of health status and cannot be denied coverage for pre-existing conditions. However, the individual marketplace remains largely unregulated by the federal government. And in welfare reform, immigrants lose access to most welfare, including Medicaid, for their first 5 years in the country. This is done presumably because Clinton promised to “End welfare as we know it” and immigrants were thought to be exploiting our overly generous welfare system. After vetoing welfare reform twice, Clinton signs the law in August 1996, months before the midterms.

Once his second term begins, Clinton immediately begins working with congressional Democrats and the GOP on a more tailored approach: coverage for children. In budget reconciliation, Clinton reaches a deal with Senator Orrin Hatch (R-UT) and Ted Kennedy to create a block grant program so that states can cover more children with more generous benefits than the 133% poverty line agreed to in the 1980s. This occurs over the opposition of Senate Majority Leader Trent Lott. The Balanced Budget Act of 1997 passes. The State Children’s Health Insurance Program is created and is set to begin by 1999. States can opt for a Medicaid run plan, an independent program, or a hybrid. And with a simple block grant, states are more free than original Medicaid to cover children how they see fit with less federal government oversight. Within a few years, all states sign up. What will become Medicare Advantage is also created as a part of this law.

Further changes are also made to use Medicaid funds to help poor seniors afford their Medicare Part B premiums, but being conducted via Medicaid, it varies by state.

President Bush narrowly wins his election in 2000, and he comes in with the same narrow GOP Congress. It’s the first time the GOP holds the White House and Congress in 46 years. But their margins are far tighter than what the Democrats typically enjoy. Choosing to maintain his promise of “Compassionate Conservatism” Bush works on bipartisan legislation to finally add a prescription drug benefit to Medicare. However, rather than following the original Medicare structure of the 1960s, they opt for a plan more similar to the AMA’s voluntary alternative. Medicare Part D is passed with controversial bipartisan support in 2003 with a planned launch in 2006. It creates a marketplace where seniors can purchase voluntary insurance. No public option exists in the system, but general revenues are used to keep premiums relatively low. Medicare is banned from price setting, and all drugs are to be sold at the market price. There is a “donut hole” in the insurance share of funding before catastrophic coverage and no out of pocket maximum. Regardless, the 2006 election is a disaster for the GOP and Democrats retake Congress.

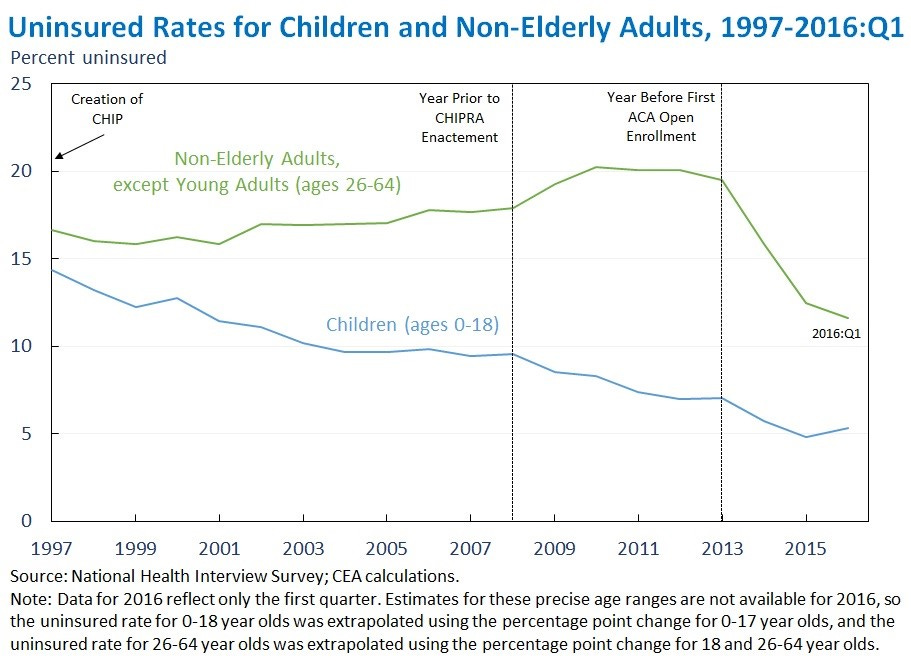

In 2007, Democrats try to use their newly formed majority to expand CHIP. The original plan was funded for 10 years, and it was about to expire. Though the uninsured rate for children had dropped from 15% to 10%, Democrats wanted to go further. They tried to double funding to cover millions more children. George W. Bush vetoes this bill arguing that this would expand coverage to the point where even middle-class families would be getting aid, which was not the original intent of CHIP. With expiration looming, Democrats concede and reauthorize original CHIP.

Yes We Can? The Affordable Care Act passes, but universal coverage remains elusive

Barack Obama is elected in 2008, and he runs on a plan to save the economy from the worst crisis since the Great Depression, and on finally achieving universal health care reform. And he has a large House majority and right up to a supermajority needed to overcome the filibuster. They will have a supermajority for a couple months, but will otherwise need to work with the GOP to pass legislation. But to start, the Democrats pass their earlier CHIP plan. The child uninsured rate will drop to as low as 5% over the next few years thanks to this law and the ACA. In many states, they expand CHIP to as high as ~320% poverty. The first few months are spent on the stimulus package and they do not yet have a supermajority, so they must continue to work with the GOP.

The plan offered by the Democrats is strikingly similar to the 1993 Clinton plan with some Dot Com add-ons. The House and Senate argue for 14 months over the specifics. The House plan wants a single national marketplace, a weak public option, subsidies, and more. The Senate plan opts for state-level market places, no public option, tax credits, etc. The House passes their bill in the fall, but the Senate takes until right before Christmas. The Senate is narrowly able to get past a GOP filibuster thanks to the interim Senator to replace Ted Kennedy (who recently died of brain cancer). Both include an expansion to Medicaid up to 133% of poverty for everyone (with a 5% disregard effectively making it 138% poverty), not just children or mothers. This emulates the threshold set in the 1980s. Market place regulations are also in both plans like eliminating the “donut hole” in Medicare Part D, elimination of life-time limits in health insurance, guaranteed issue regardless of health status like employer insurance, free preventative care, a collection of essential benefits, defined employer coverage mandates, and more. In order to avoid adverse selection, they add an “individual mandate” requiring purchase of insurance or facing a penalty (like Switzerland, Germany, and Japan) but at a much lower rate such that many would still save money paying the penalty rather than getting insured. Unlike the Clinton plan, this plan does not attempt to address real costs. They do this to avoid the coalition building against the plan like in the past, and it works. By convincing the AMA and AHA their profits will be maintained, they throw their support behind the plan.

The plan is to create a conference committee to hammer out the differences and pass a final law. Instead, Martha Coakley losses the election in Massachusetts in January. Suddenly, Democrats lose their supermajority in the Senate, and Republicans look set to defeat legislation once again. And budget reconciliation, an arcane process, may not allow large swaths of the regulatory changes to the marketplace Democrats want. Obama’s Chief of Staff, Rahm Emmanuel, argues that Democrats should cut their losses and go for a skinnier plan like CHIP. House Speaker Nancy Pelosi disagrees and vows to push forward. Because the Senate already passed their law in regular order, the House could send the law to Obama’s desk if they accept the Senate bill, the ACA, as is. They narrowly pass the law in March 2010, even with a large House majority. The ACA is the law of the land and will be phased in over 4 years, both to lower the cost assessment of the Congressional Budget Office and to give the market time for things to be set up, much like Medicare Part D or CHIP. Over the next month, Democrats make mild changes in budget reconciliation. In the midterms, the Democrats lose the House and narrowly hold the Senate. Democrat’s time writing laws on their own is over until 2021.

Furthermore, those ACA subsidies for the marketplace are only for people ranging from 100%-400% poverty. So, if you make a cent more than the limit, you do not qualify for subsidies and must pay the expensive unsubsidized rate. By preventing insurers to charge based on health status, they raised the price for healthy people, and most people are healthy. So, if you are quite sick, the ACA made individual coverage affordable for the first time. If you are healthy and make more than 400% poverty, your premiums rose considerably. They also allowed older enrollees to be charged more than younger enrollees to avoid pricing out the young too much. Finally, to appease employees with good employer plans, they created an “employer insurance firewall” where people offered ESI couldn’t get subsidies unless their employers didn’t meet a minimum standard. As a result, many people with employer insurance could find cheaper plans on the ACA if they were given subsidies. But those good union plans from earlier were protected thanks to the employer mandate and the firewall.

In 2012, the Supreme Court upholds the ACA and the individual mandate, but makes the Medicaid Expansion voluntary like past welfare expansions. Their reasoning is that the Medicaid Expansion, which will cover able-bodied non-parent adults, is a de facto new program and states should have the choice to opt-in or not. Furthermore, threatening states with losing their Medicaid funding if they do not expand is a “deal you cannot refuse” and is struck down. As a result of this decision, 12 states have not expanded Medicaid to this day and 2.2 million people are in what is called the “Medicaid Gap”. Too poor for ACA subsidies, but too rich for their states’ non-expansion Medicaid programs.

Regardless of the problems, the marketplace begins in 2014, and the uninsured rate plummets. It’s the largest drop in the uninured rate since Medicare. From about 15% to 8%. Almost as large as the 10-percentage point drop from Medicare and Medicaid.

President Trump attempts repeal of the ACA with a GOP Congress in 2017, but it fails by a single vote in the Senate after passing the House. Instead, they opt to eliminate the individual mandate in the TCJA, and Trump allows for “short term plans” unregulated by the ACA year-round. Regardless of attempts of sabotage, the system is maintained and upheld in the courts. But while the ACA cut the uninsured rate in half once more, universal health care remains elusive. Some people refuse their employer plans and don’t buy other plans, some people are undocumented and cannot purchase plans, some are stuck in the Medicaid gap, some simply choose not to buy a plan, and half the uninsured are eligible for Medicaid or ACA subsidies and don’t sign up. Oftentimes, they site the cost, but burdens of selecting among dozens of plans is a headache. We now have a system where nearly half of Americans have employer insurance, about 35% of Americans have some public plan (Medicare, Medicaid, VA care, or CHIP), and about 15 million people (about 5%-6%) purchase marketplace plans. With all the gaps and cracks in between.

In 2021, Democrats passed increased subsidies to eliminate the subsidy cliff for 2 years, and want to force a type of coverage for people in the Medicaid gap population. But whether these changes happen and become permanent remains to be seen. We are closer than ever to universal access to health care, and its realization, but we are not there yet. The system, clunky and expensive, remains with more coverage than ever before. Socialized medicine for veterans, national health insurance with private plans within it for the elderly, public and private state Medicaid plans for the poor, state CHIP plans for poor and often middle-class children, a large employer sponsored set up with growing costs every year for half of Americans, and an imperfect and messy marketplace for the rest that is better than what came before.