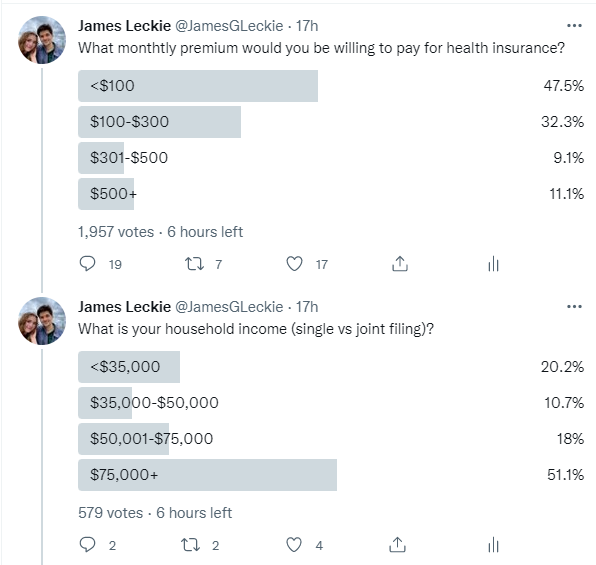

Yesterday, I asked the question, “What monthly premium would you be willing to pay for health insurance?” These were the results.

About 80% of respondents said they would only be willing to pay $300 per month or less ($3,600 annually), while nearly half would only be willing to pay less than $100 per month (<$1,200 annually). This is despite the fact that over half of respondents self-identify as making more than $75,000 per year. Seeing this, you might think that the United States has a massive rate of uninsurance. Let’s look at the uninsured rate in the US.

In other words, the uninsured rate is much lower than my unscientific Twitter poll would have you believe. But maybe it’s different by income. Let’s check.

Finally, you might think this is a matter of personal risk to your health. Let’s look at this by age as a quick check. Young people tend to be healthy.

As you may expect, the older someone gets, the more likely they are to have health insurance. However, the uninsured rate is quite low for children, then rises substantially among young adults. Both young adults and children are inexpensive to insure, so why is it so different in the US? How is it so different in countries that actually have universal health coverage? The answer may come down to this: subsidized demand, public insurance, and choice (or lack thereof).

Many people said they would not be willing to spend anything on premiums, because it should be paid for via taxation. Problems with stated preference versus revealed preference aside (I doubt many of these people are uninsured or don’t pay any premiums), this does tell us something about individual demand for health insurance. Left to purchase health insurance on our own, many people may choose to forgo insurance. This could be for a host of reasons: people may be unable to afford their premiums, people may not understand how insurance works and feel overwhelmed by having to decide, they may simply believe they are healthy and don’t need to pay for it, et cetera. One commenter mentioned that they have a price they are willing to pay, but would simply rather purchase it if or when they got sick. This all gives us a good examination into personal choices and a product like health insurance.

Let’s deal with the moral hazard of the person that said they would simply avoid purchasing it until they get sick. Many countries handle this in a number of ways. In Canada or the United Kingdom, for example, they simply have a public insurance system or socialized medicine where you are given insurance or health care regardless of your personal preferences, which is paid for via taxation of the wider population. There’s no relative choice to be made, and no real ability to escape the system. You received this good, and The State compels you to pay for it. Another alternative is a system like Germany or Switzerland. The insurance is to some degree private, and you need to choose a plan. However, the government forces you to choose. If you don’t pay your premiums, they can garnish wages and make you pay. This could be expensive, so Germany caps it to 14.6% split evenly between employer and employee up to the first $60,000 when the cost is capped; you can also choose private coverage as well. In Switzerland, they offer some help, but they compel you to purchase it.

The United States chooses neither option. We have a mixed system, but the private system does not compel you. We do have annual sign ups, though. If you forgo insurance for a year, you have to wait until next year to sign up, or go with a short-term plan. We had an individual mandate for a time under the Affordable Care Act (ACA), but it was set to $0 in 2017. So, you might think that many young and healthy people would choose to opt out of the system each year and only take the insurance when they truly needed it. After all, guaranteed issue and the community rating in the ACA ensure you pay the same amount regardless of health status (with the exception of age and smoking status on the marketplace). However, that isn’t the case. The vast majority of people have some form of health insurance even if their stated preference is that they don’t want to pay much for it. Why is that?

It would be irresponsible not to mention that 87 million Americans were on Medicaid or the Children's Health Insurance Program (CHIP) in January 2022. That’s about one quarter of the population. The vast majority of people on Medicaid do not pay premiums, though some parents pay premiums for CHIP. Funding comes from taxation just like people said they would prefer responding to my poll. And of course, the roughly 28 million uninsured Americans don’t pay any premiums either. But what about the rest of us? Like we saw above, the uninsured rate for the elderly was very low, but not zero. Surely, they must not be paying premiums either?

(Taken from https://www.medicare.gov/your-medicare-costs/part-b-costs)

While most seniors pay nothing for Medicare Part A (Hospital Insurance), they often pay hundreds of dollars for Medicare Part B (Medical Insurance) premiums. They also have to spend more for Part D drug coverage. Some take zero premium Medicare Advantage plans, some poor seniors get assistance paying for their premiums via Medicaid, but virtually no one goes without it. And some seniors are quite healthy and wealthy, so you suspect you’d have more people avoiding coverage. Well, we do a few things to nudge them in the direction of coverage. First, Medicare Part A is free for most people, so they will take it. Second, seniors often need a lot of care, so many take it. Third, seniors can be penalized for delaying coverage. Fourth, the Social Security Administration can automatically deduct your premiums from your benefits, so you don’t have to think about it. That makes it really easy to get coverage and move on with your life, and I think that’s the key factor for why the uninsured rate isn’t higher in the United States.

Medicare isn’t the only program that does this. Employer Sponsored Health Insurance does this too in a couple different ways. Employers have a share of your premiums that they cover. They handle this on their own during payroll. But you often have a share you need to pay as well. If it was over $100, many poll respondents say they wouldn’t take it. I think they take it in part because they may lose what feels like free help and take a de facto pay cut from their employer, or simply because it gets taken out automatically as well and they don’t miss it. Maybe you have someone that’s crafty and negotiates for a higher salary, but very few people that get an employer offer go without coverage and many people not negotiate this. They also don’t have too many options when selecting an employer plan each year, so there isn’t much overload. The power of defaults is strong.

That’s not as easy for the ACA marketplace (Obamacare). You often have dozens of plans to choose from. You have to enter in your planned income rather than just getting your side of it from your employer. You have to proactively search for the website every year rather than have your employer notify you when it’s time to do so. Then, when you choose a plan, you can choose to have premiums set up for automatic payment or not. What if you don’t have a credit card, or internet? What if you have unstable paychecks and need to plan it out? What if the amount after subsidies is higher than you are willing to pay? Even though Obamacare enrollees are a relatively small group (only about 15 million Americans shop for their own insurance), they make up a large chunk of the uninsured. And they have to look at their premiums every month. And many are relatively young. With all these reasons building up, maybe it’s just easier to go without it?

You can solve this problem in a number of ways. Like I mentioned earlier, Canada gives it to you and taxes the cost back. Medicaid does the same. You can make it free like Medicare Part A and set up a penalty for delaying. You can set up a penalty like Medicare Part B and compel people to purchase it like Germany or Switzerland, or how we do for car insurance. You can even have the payments come out of your paycheck or bank account automatically with help from the IRS or Social Security Administration. All of these answers can lead to universal health coverage in either a public insurance system, a private insurance system, a mixed system, or via socialized medicine. Alternatively, you can make people wait and even shut them out for a time, which we do for a short period. In fact, Uwe Reinhardt, a health economist who helped design Taiwan’s single payer system, hypothesized the ultimate choice in Priced Out. Tell people they must opt in to the system and start paying for some type of qualifying coverage, or be locked out of its protections for life. While harsh in nature, that would make people think hard before saying no.

I’d rather we just take away the choice to say no and give people some basic coverage if they refuse everything else, but there’s no shortage of options to solve this problem. Now we just need to settle on one…if we want to.

We need health insurance these days!

We wrote an article about the crippled state of the Canadian healthcare system:

https://klarityvipwriters.substack.com/p/waiting-for-healthcare-in-canada

For Canadian readers, we have a Calgary-based company offering premium health insurance for an incredibly affordable price. It could actually save your life; we find the top doctors & treatments world-wide for you, at no extra charge. Visit our page here https://www.klarityvip.com/