Administrative Burdens and the Uninsured

The story of the uninsured in America is primarily a story of policy defaults and administrative burdens.

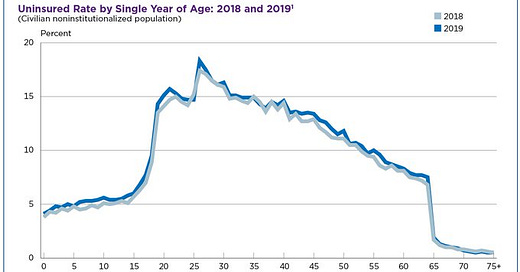

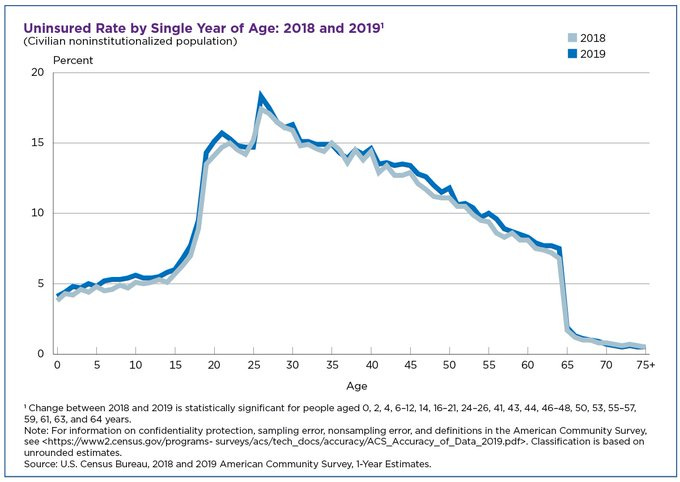

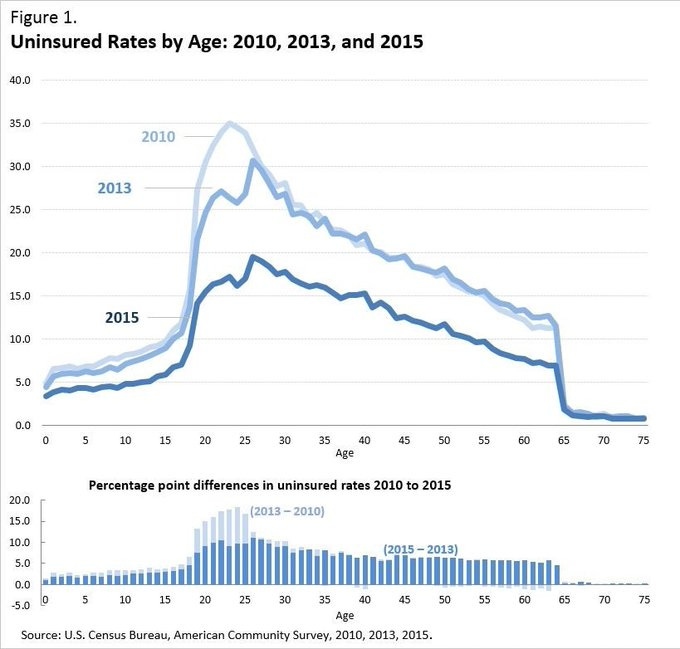

The biggest spikes in uninsurance come around age 18, when people become legal adults, and 26, when they can no longer remain on their parent's insurance. The biggest drop in the uninsured rate? When people become eligible for Medicare at age 65.

If you're a kid, your parents can sign you up on your behalf, you can be added to their insurance whether an individual family plan or an employer plan. If they can't quite afford it, Medicaid and the Children’s Health Insurance Program (CHIP) are far more generous for kids than adults. We really want kids to be insured. But still, that uninsured rate is closer to around 5%.

But when you turn 65, the government really goes out of it's way. You can opt out of Medicare Part B for a time if you want to and have a replacement, but you HAVE to take Part A for hospitals. You're 65, that's what you get. You're good.*

But when you turn 18, you're mostly on your own. Figure it out. People that fill out FAFSA forms on their own or file taxes for the first time can empathize with this. It's stressful. The Affordable Care Act (ACA) lets you stay on your parents’ insurance until 26, but that's not always an option. Family plans can be very expensive. Especially if parents have mixed coverage between them. Not all young adults have a good relationship with their parents. As a result, the uninsured rate skyrockets.

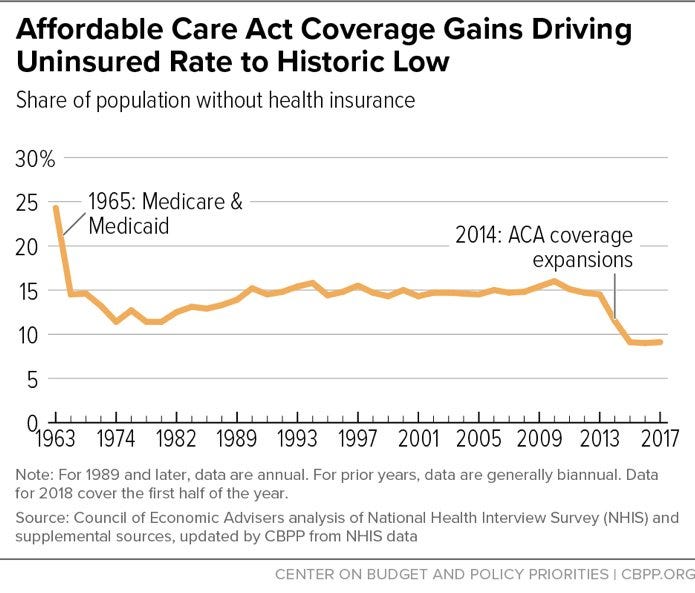

The good news is the ACA partially addressed this. By expanding Medicaid and improving the marketplace with a website (Healthcare.gov or a collection of state sites), subsidies, and a collection of regulations to prevent insurers from denying coverage; the uninsured rate went down over time. Mostly among adults, particularly young adults.

But the bad news, the ACA didn't get all the eligible like Medicare did. Half the uninsured are eligible for premium free plans! Why? It defaults to no insurance, just like before. And "default no" leaves eligible needy people behind.

And aside from underinsurance, people switch jobs, there's natural churn in the economy. Just like when you move and have to switch your address for bunch of places and utilities. You do that with health insurance and with jobs, and it's not as immediately visceral as electricity for many people.

If you lose your job, are you going to keep paying your premiums completely on your own? Probably not, you’d rather have the cash. Are you going to shop around for a short term plan? Quality there varies and you may be healthy. Why not try and keep the extra cash? Odds of getting in an accident are low (but not zero) after all.

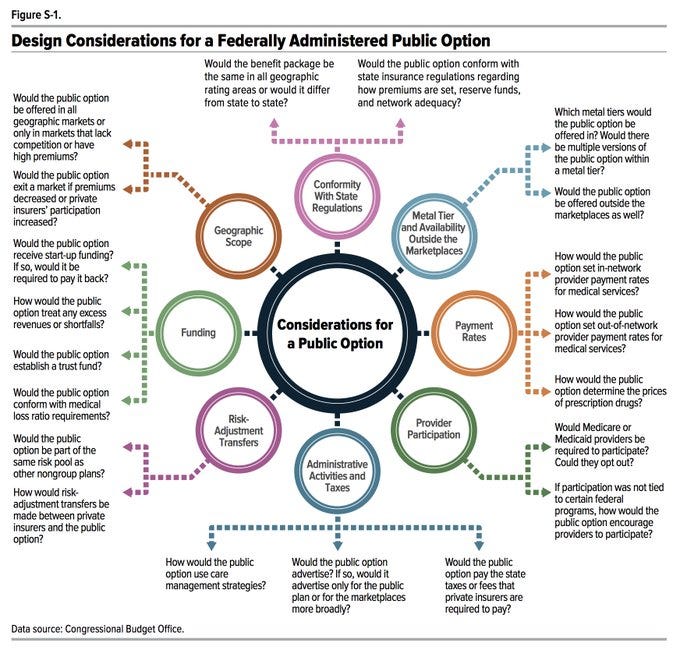

Many people point out public options as a way to fix this problem. But many public option proposals are just another option, not a default yes. And their availability changes heavily among proposals. Will it only be an option for ACA enrollees, or employers with an employer offer too? Will it be everywhere, or just where there is a lack of competition? Will it be a part of the state ACA risk-adjustment market, or will it be considered separate? Will it be a true public option or something like a private Medicaid Managed Care Organization or private Medicare Advantage? There are plenty of questions to answer.

Then there's problems of too much choice! Employer insurance may only give you a few options. But the ACA marketplace can offer dozens along four metal levels assuming you understand the difference! And different metal levels have different shares of premiums vs deductibles, etc.

The ACA reduced the uninsured rate almost as much as Medicare and Medicaid. But administrative burdens and policy defaults left a lot of money on the table and many eligible people uninsured. The good news is they are eligible. We just need to take administrative burdens seriously.

*Note: Most people don’t have to pay premiums for Medicare Part A, unless you have less than 10 years of work experience and aren’t a spouse of a working adult. In that case, you have premiums and they can be expensive. It’s why the uninsured rate for seniors isn’t zero. Source: https://www.medicare.gov/your-medicare-costs/part-a-costs